Learn More About The Possibility For Economic Experts' Experience To Boost Your Economic Overview

Content Author-Middleton Torp

When it pertains to your retired life planning, the assistance of a monetary consultant can be critical in browsing the complicated landscape of financial choices. From establishing achievable economic objectives to crafting tailored retired life strategies, their knowledge can make a substantial effect on securing your financial future. Recognizing the crucial role a monetary expert plays in shaping your retirement can offer clarity and instructions in accomplishing your lasting monetary purposes.

Benefits of Working With an Economic Expert

When preparing for retirement, working with a monetary consultant can supply you with indispensable support and know-how. A monetary expert brings a wide range of understanding to the table, assisting you browse the complex globe of retirement preparation effortlessly. They can help you in establishing practical economic goals, developing a customized retirement plan, and making informed financial investment decisions tailored to your needs and run the risk of tolerance.

One of the crucial benefits of collaborating with a monetary advisor is their ability to help you maximize your retirement savings. By examining your present financial circumstance and future requirements, they can develop approaches to maximize your cost savings possible and make certain a comfy retirement. Furthermore, financial consultants remain up-to-date with the latest market patterns and investment opportunities, enabling you to make knowledgeable decisions that straighten with your long-term objectives.

Additionally, a financial advisor can supply you with satisfaction by offering ongoing assistance and confidence throughout your retirement journey. They can aid you change your economic plan as required, resolve any type of worries or unpredictabilities you may have, and eventually equip you to make certain monetary decisions that pave the way for a safe and secure and fulfilling retired life.

Services Used by Financial Advisors

Financial advisors offer a range of solutions to assist you in managing your finances and preparing for retired life successfully. These experts can aid you develop an individualized monetary plan customized to your specific objectives and needs. They supply support on financial investment methods, possession allowance, and threat administration to help you develop a strong economic foundation for your retired life.

Additionally, monetary consultants supply expertise in tax obligation planning, aiding you optimize your tax obligation circumstance and maximize your savings. https://www.advisorperspectives.com/articles/2024/05/08/can-power-corrupt-you-dan-solin can also help with estate preparation, guaranteeing that your properties are distributed according to your dreams. Retirement income planning is an additional essential solution given by financial advisors, assisting you figure out exactly how to produce a consistent income during your retirement years.

Additionally, these experts offer recurring tracking and modifications to your financial plan as required, maintaining you on course to satisfy your retired life objectives. By leveraging the services of a monetary advisor, you can get assurance knowing that your financial future is in capable hands.

How to Select the Right Financial Expert

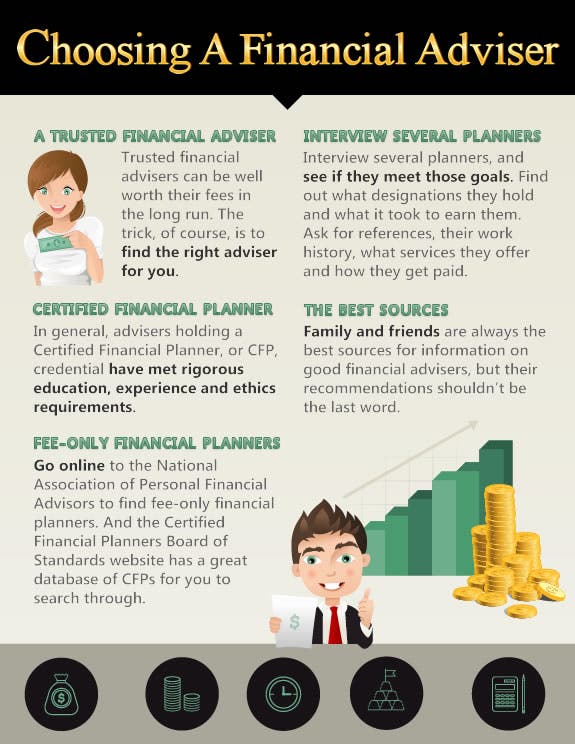

To discover the right economic advisor for your retirement planning requirements, consider reviewing their qualifications and experience in the field. Try to find advisors who hold relevant certifications like Qualified Economic Organizer (CFP) or Chartered Financial Specialist (ChFC). These designations indicate a specific degree of knowledge and commitment to maintaining industry criteria.

Additionally, evaluate the advisor's experience dealing with customers that are in or near retired life. simply click the following web site that concentrates on retirement preparation will likely have a deeper understanding of the unique difficulties and chances that include this life stage.

When picking a monetary expert, it's additionally critical to consider their charge framework. Some experts charge a flat cost, while others work with a payment basis. Ensure you comprehend just how your expert obtains made up to prevent any type of potential conflicts of passion.

Finally, seek out suggestions from pals or family members that have actually had favorable experiences with their own monetary advisors. Personal references can provide useful understandings into an advisor's interaction style, reliability, and general efficiency in aiding clients reach their retired life objectives.

Verdict

To conclude, dealing with a monetary consultant is crucial for successful retirement planning. Their knowledge and support can assist you set practical monetary objectives, produce tailored retirement, and make educated financial investment decisions customized to your needs.

By selecting the ideal financial expert, you can significantly boost your retirement readiness and financial well-being. Take the initial step in the direction of a secure retired life by looking for the support of a trusted economic expert today.